Our set of API allows you to integrate our services, manage organisations, users in a simple and programmatic way, using conventional HTTP requests. The endpoints are intuitive and powerful, allowing you to easily make calls to retrieve information or to execute actions.

The API documentation will start with a general overview about the design and technology that has been implemented, followed by reference information about specific endpoints.

Callpay offers seamless integration with a wide range of popular eCommerce platforms and plugins, making it easy for merchants to enable secure payments without complex development. Supported Platforms include Magento and WordPress with WooCommerce plugin. These ready-to-use Platforms and plugins ensure quick setup, reliable performance, and full access to Callpay’s secure payment features

php bin/magento setup:upgradephp bin/magento cache:cleanTake instant eft payments on your WooCommerce store using Callpay. Accept payments directly into your bank account.

In settings you can configure your success, refund and error webhook urls. The result will be sent as an HTTP POST request in the following format:

We do not have static IPs to whitelist and we recommend doing lookup api calls:

Payments: /api/v1/gateway-transaction/$GATEWAY_TRANSACTION_ID

Payouts: /api/v1/payout/100/$PAYOUT_TRANSACTION_ID

POST = [

'success' => {1 or 0}

'status' => {statusString}

'organisation_id' => {merchant_id}

'amount' => {amount}

'callpay_transaction_id' => {gateway_transaction_id}

'reason' => ‘{reasonForFailureIfApplicable}’

'user' => ‘{paymentUser}’

'merchant_reference' => ‘{merchant_reference}’

'gateway_reference' => ‘{psp_reference}'

'gateway_response' => ‘{additionalDataFromPSP}’

'currency' => ‘{currency}’

'payment_key' => ‘{payment_key}’

]

POST = [

'success' => {1 or 0}

'organisation_id' => {merchant_id}

'refunded_amount' => {amountRefunded}

'callpay_transaction_id' => {gateway_transaction_id}

'reason' => ‘{reasonForFailureIfApplicable}’

'user' => ‘{paymentUser}’

'merchant_reference' => ‘{merchant_reference}’

'gateway_reference' => ‘{psp_reference}'

'currency' => ‘{currency}’

'payment_key' => ‘{payment_key}’

'gateway_response' => ‘{additionalDataFromPSP}’

]

| Payment Methods | Integration methods |

|---|---|

| Agent Assist A call center service for taking payment details while on call. | Redirect & Enterprise |

| Agent Request A call center service for taking payment details over network initiated USSD | Enterprise |

| Credit Card Payments A website or mobile service for accepting credit card payments via a redirect. | Checkout & Redirect & Enterprise |

| EFTsecure A website or mobile service for accepting instant EFT | Checkout & Redirect & Enterprise |

| Notify Express (Pay by Link) A notification service for Pay Direct and EFTsecure. Email, SMS and Link supported. | Enterprise |

Any tool that is fluent in HTTP can communicate with the API simply by requesting the correct URI. Requests should be made using the HTTPS protocol so that traffic is encrypted. The interface responds to different methods depending on the action required.

| Method | Usage |

|---|---|

| GET |

For simple retrieval of information you should use the GET method. The information you request will be returned to you as a JSON object. |

| DELETE |

To destroy a resource and remove it from your account and environment, the DELETE method should be used. |

| PUT |

To update the information about a resource in your account, the PUT method is available. |

| POST |

To create a new object, your request should specify the POST method. The POST request includes all of the attributes necessary to create a new object. When you wish to create a new object, send a POST request to the target endpoint. |

Along with the HTTP methods that the API responds to, it will also return standard HTTP statuses, including error codes.

In the event of a problem, the status will contain the error code, while the body of the response will usually contain additional information about the problem that was encountered.

In general, if the status returned is in the 200 range, it indicates that the request was fulfilled successfully and that no error was encountered.

Return codes in the 400 range typically indicate that there was an issue with the request that was sent. Among other things, this could mean that you did not authenticate correctly, that you are requesting an action that you do not have authorization for, that the object you are requesting does not exist, or that your request is malformed.

If you receive a status in the 500 range, this generally indicates a server-side problem. This means that we are having an issue on our end and cannot fulfill your request currently.

{

"name": "Unauthorized",

"message": "",

"code": 0,

"status": 401,

"type": "yii\\web\\UnauthorizedHttpException"

}

When a request is successful, a response body will typically be sent back in the form of a JSON object.

For example, if you send a GET request to /api/v1/user/$USER_ID you will get back an object for that user. If you send the GET request /api/v1/organisation/$ORGANISATION_ID/user you will get back an array of objects.

{

"id": 1,

"name": "John",

...

}

[

{

"id": 1,

"name": "John",

...

},

{

"id": 2,

"name": "Joe",

...

},

{

"id": 3,

"name": "Jane",

...

}

]

A token must be sent in the headers of a request for authentication

A token can be created for a user by making an API call with basic authentication (a valid user's username and password must be sent as credentials) to following URL:

Keep in mind that Agent users are limited to service api calls that they are authorised to use.

curl -X POST -u validusername:validpassword https://eft.ppay.io/api/v1/token

{

"token": "b5cfaae0e94e79d0073f4925143dca2c",

"expires": "2016-09-07 08:46:16"

}

Some of these constants are required for certain API calls.

These are the service IDs available to your organisation.

| ID | Service |

|---|---|

| 2 | Agent Assist |

| 10 | Agent Request |

| 11 | Notify Express |

| 5 | Inbound |

| 4 | POS |

| 12 | EftX |

| 13 | Direct |

| 14 | Payouts |

| 17 | Manual Payments |

| 26 | Realtime EFT |

List of available gateways

| ID | Gateway |

|---|---|

| 6 | Peach Payments |

List of available user roles

Post with string value

eg.

| Role | Description |

|---|---|

| administrator | User that can manage the organisation and users |

| agent | Call centre agent that uses our services |

List of available contract types for newly created organisation

eg.

| Contract type id | Description |

|---|---|

| 1 | 24 month contract |

| 2 | Pre Paid contract |

Allows agents and apps to make use of our services through the API.

Initialise Assist transaction. Organisation id is required in url

Request Method: POST

Url: https://eft.ppay.io/api/v1/organisation/$ORGANISATION_ID/assist/init

Will return websocket url, token and extension to transfer call to.

For authentication use BasicAuth with agent's username and password.

Post parameters:

| Attribute | Type | Description | Required |

|---|---|---|---|

| amount | decimal | ie. 10.00 | Yes |

| reference | string | custom reference | No |

This can then be used for monitoring the IVR progress with websockets. See example html and javascript on assist_example.html page on how to use the response parameter values to get IVR progress in realtime. NB: Websockets can only be streamed from HTTP and not HTTPS. The limitation is set as SSL certificates needs to be in place to use WSS

curl -X POST -u validusername:validpassword https://eft.ppay.io/api/v1/organisation/10/assist/init -d "amount=25.00&reference=your_reference"

{

"wsUrl": "wss://services.callpay.com",

"wsToken": "{$ORGANISATION_ID}_{$AGENTCH}_{$ONE_TIME_TOKEN}",

"transferExtension": "11*1*1111"

}

Request Method: POST

Url: https://eft.ppay.io/api/v1/assist/edit-step

This sends a request to server to reset current step. No response sent back.

For authentication use BasicAuth with agent's username and password.

Post parameters:

| Attribute | Type | Description | Required |

|---|---|---|---|

| step | integer | The number of the step to edit | Yes |

See example html and javascript on assist_example.html page on how to integrate.

curl -X POST -u validusername:validpassword https://eft.ppay.io/api/v1/assist/edit-step

200 OK

Request Method: POST

Url: https://eft.ppay.io/api/v1/assist/next-step

See example html and javascript on assist_example.html page on how to integrate.

For authentication use BasicAuth with agent's username and password.

curl -X POST -u validusername:validpassword https://eft.ppay.io/api/v1/assist/next-step

200 OK

Request Method: POST

Url: https://eft.ppay.io/api/v1/assist/reset-all

This sends a request to server to reset all steps. No response sent back.

See example html and javascript on assist_example.html page on how to integrate.

For authentication use BasicAuth with agent's username and password.

curl -X POST -u validusername:validpassword https://eft.ppay.io/api/v1/assist/reset-all

200 OK

Request Method: POST

Url: https://eft.ppay.io/api/v1/assist/process-payment

Post parameters:

| Attribute | Type | Description | Required |

|---|---|---|---|

| callId | integer | valid call id | Yes |

See example html and javascript on assist_example.html page on how to integrate.

curl -X POST -u validusername:validpassword https://eft.ppay.io/api/v1/assist/process-payment -d "callId=$CALL_ID"

{

"success": "1",

"detail": {

"displaymessage": "Successful",

"merchantreference": "ref_1425983543",

"reference": "389451136137",

"paymentmethodsused": {

"amountincents": "1055",

"cardexpiry": "122015",

"cardnumber": "511112******1349",

"gatewayreference": "37588444",

"information": "MASTERCARD",

"nameoncard": "John Doe"

},

"resultcode": "00",

"resultmessage": "Successful",

"successful": "true"

}

}

Initialise Request transaction

Request Method: POST

Url: https://eft.ppay.io/api/v1/request/init

Will return websocket url and token.

For authentication use BasicAuth with agent's username and password.

Post parameters:

| Attribute | Type | Description | Required |

|---|---|---|---|

| amount | decimal | ie. 10.00 | Yes |

| mobile_number | integer | A valid mobile number | Yes |

| reference | string | custom reference | No |

curl -X POST -u validusername:validpassword https://eft.ppay.io/api/v1/request/init -d "amount=25.00&reference=your_reference"

{

"wsUrl": "wss://services.callpay.com",

"wsToken": "{$ORGANISATION_ID}_{$AGENTCH}_{$ONE_TIME_TOKEN}"

}

Send USSD request for card number

Request Method: POST

Url: https://eft.ppay.io/api/v1/request/card

For authentication use BasicAuth with agent's username and password.

curl -X POST -u validusername:validpassword https://eft.ppay.io/api/v1/request/card

{

"result": "{\"code\":200,\"description\":\"OK\",\"message\":\"OK\"}"

}

Send USSD request for cvv number

Request Method: POST

Url: https://eft.ppay.io/api/v1/request/cvv

For authentication use BasicAuth with agent's username and password.

curl -X POST -u validusername:validpassword https://eft.ppay.io/api/v1/request/cvv

{

"result": "{\"code\":200,\"description\":\"OK\",\"message\":\"OK\"}"

}

Save expiry date for current request transaction

Request Method: POST

Url: https://eft.ppay.io/api/v1/request/expiry-date

For authentication use BasicAuth with agent's username and password.

Post parameters:

| Attribute | Type | Description | Required |

|---|---|---|---|

| expiry_date | String | Must be formatted MMYYYY ie. 032017 for March 2017 | Yes |

curl -X POST -u validusername:validpassword https://eft.ppay.io/api/v1/request/expiry-date -d "expiry_date=032017"

{

"result": "true"

}

Request Method: POST

Url: https://eft.ppay.io/api/v1/request/process-payment

For authentication use BasicAuth with agent's username and password.

curl -X POST -u validusername:validpassword https://eft.ppay.io/api/v1/request/process-payment

{

"success": "1",

"detail": {

"displaymessage": "Successful",

"merchantreference": "ref_1425983543",

"reference": "389451136137",

"paymentmethodsused": {

"amountincents": "1055",

"cardexpiry": "122015",

"cardnumber": "511112******1349",

"gatewayreference": "37588444",

"information": "MASTERCARD",

"nameoncard": "John Doe"

},

"resultcode": "00",

"resultmessage": "Successful",

"successful": "true"

}

}

Request Method: POST

Monitor Url: https://eft.ppay.io/monitor-web-view

Assist Url: https://eft.ppay.io/assist-web-view

Request Url: https://eft.ppay.io/request-web-view

Integration Type: Service Redirect

This sends a request to the relevant service web view

NB: Authentication Token must be posted with params

Post parameters:

| Attribute | Type | Description | Required |

|---|---|---|---|

| X-Token | string | A valid auth token | Yes |

| amount | decimal | ie. 10.00 | Yes |

| redirect_url | string | Url to redirect to after transaction | No |

| payment_success_url | string | Url to post transaction result to after successful transaction | No |

| payment_failed_url | string | Url to post transaction result to after unsuccessful transaction | No |

| reference | string | custom reference for transaction | No |

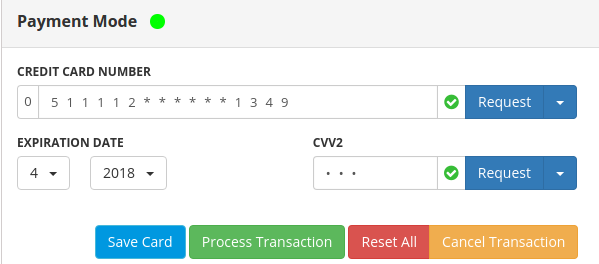

Once all credit card fields have validated on our redirect service pages the process payment button will become available to click. If tokenization is enabled on the payment gateway a "Save Card" button will also appear. Instead of processing payment as normal this would tokenize the card details for usage later. See image below:

Once card details have been tokenized the page will redirect to your redirect url with the result in the GET parameters. To make payment using the saved token you will use the unique reference that you submitted to the redirect web view. See Scheduled Payments and and Real-time Token Payments for more information on how to pay by token.

Get express link.

Request Method: POST

Url: https://eft.ppay.io/api/v1/express/get-link

Will return a link to the express transaction.

Post parameters:

| Attribute | Type | Description | Required |

|---|---|---|---|

| amount | decimal | ie. 10.00 | Yes |

| reference | string | custom reference | No |

| organisation_id | integer | Partners only | No |

| expiry_date | date | DD-MM-YYYY | No |

curl -X POST -u validusername:validpassword https://eft.ppay.io/api/v1/express/get-link -d "amount=25.00&reference=test"

{

"id": 96,

"link": "https://eft.ppay.io/u/331e902aa"

}

Send sms with express transaction link.

Request Method: POST

Url: https://eft.ppay.io/api/v1/express/sms

Will send an sms with express transaction link to user's mobile phone.

Post parameters:

| Attribute | Type | Description | Required |

|---|---|---|---|

| amount | decimal | ie. 10.00 | Yes |

| reference | string | custom reference | No |

| number | string | valid mobile number | Yes |

| expiry_date | date | DD-MM-YYYY | No |

| organisation_id | integer | Partners only | No |

curl -X POST -u validusername:validpassword https://eft.ppay.io/api/v1/express/sms -d "amount=25.00&reference=test&number=27821112222"

{

"id": 96,

"recipient": "https://eft.ppay.io/u/331e902aa"

}

Send email with express transaction link.

Request Method: POST

Url: https://eft.ppay.io/api/v1/express/email

Will send an email with express transaction link to user's email address.

Post parameters:

| Attribute | Type | Description | Required |

|---|---|---|---|

| amount | decimal | ie. 10.00 | Yes |

| reference | string | custom reference | No |

| string | valid email address | Yes | |

| expiry_date | date | DD-MM-YYYY | No |

| organisation_id | integer | Partners only | No |

| files[] | post array of files | File attachments should be posted as array | No |

curl -X POST -u validusername:validpassword https://eft.ppay.io/api/v1/express/email -d "amount=25.00&reference=test&email=jondoe@domain.com"

{

"id": 96,

"link": "http://eft.ppay.io/u/331e902aa"

}

Send sms with Rich Business transaction link.

Request Method: POST

Url: https://eft.ppay.io/api/v1/express/rbm

Will send an sms with express transaction link to user's mobile phone.

Post parameters:

| Attribute | Type | Description | Required |

|---|---|---|---|

| amount | decimal | ie. 10.00 | Yes |

| reference | string | custom reference | No |

| number | string | valid mobile number | Yes |

| expiry_date | date | DD-MM-YYYY | No |

| organisation_id | integer | Partners only | No |

curl -X POST -u validusername:validpassword https://eft.ppay.io/api/v1/express/rbm -d "amount=25.00&reference=test&number=27821112222"

{

"id": 96,

"link": "https://eft.ppay.io/u/331e902aa"

}

Cancel a express transaction via the API.

Request Method: DELETE

Url: https://eft.ppay.io/api/v1/express

Parameters:

| Attribute | Type | Description | Required |

|---|---|---|---|

| id | integer | 100 | OR→reference |

| reference | string | merchant unique reference | OR→id |

| organisation_id | integer | Partners only | No |

curl --request DELETE -u validusername:validpassword --url https://eft.ppay.io/api/v1/express --header 'content-type: application/x-www-form-urlencoded' --data id={expressTransactionID} curl --request DELETE -u validusername:validpassword --url https://eft.ppay.io/api/v1/express --header 'content-type: application/x-www-form-urlencoded' --data reference={yourReference}

{

"id": {expressTransactionID},

"status": "deleted"

}

The payment key is a setup identifier for each payment and required by all our payment methods and Checkout integrations.

Url: https://eft.ppay.io/api/v1/payment-key

The response will contain a key that can be used for the checkout widget or redirect.

Important notes for EFT payments

Shared parameters:

| Attribute | Type | Description | Required |

|---|---|---|---|

| token | Auth token | ie. c8e542542bcd6b35a5bb708a6df66f08 | If no basic auth |

| amount | decimal[10,2] | 10.00 | Yes |

| merchant_reference | string | transaction reference for merchant | Yes |

| customer_reference | string | transaction reference for customer | No |

| success_url | string | Redirect url for success | No |

| error_url | string | Redirect url on error | No |

| cancel_url | string | Redirect url on cancel | No |

| notify_url | string | Webhook for getting notified about results | No |

| payment_type | string |

Which payment type to offer the customer eg:

all

eft

credit_card

Will determine hosted endpoint in response. |

No |

| currency_code | string | Country currency code, will return supported services for that currency eg. [ZAR] Will default to the organisation default currency |

No |

EFT payment parameters:

| Attribute | Type | Description | Required |

|---|---|---|---|

| customer_bank | string | For pre-selecting a bank for the first step | No |

| listed_beneficiary_account | string OR associative array(see above**) | The account number reference for the customer if merchant is public listed beneficiary at the bank | No |

| default_beneficiary_reference | string | The default reference when creating the beneficiary. Useful for account numbers. | No |

| beneficiary_account_number | string | To override beneficiary account number. | No |

| beneficiary_name | string | To override beneficiary name. | No *required if beneficiary account number set |

| beneficiary_account_type | string | Beneficiary account type [cheque, savings, transmission] |

No *required if beneficiary account number set |

| beneficiary_bank | string |

Beneficiary account number bank [ABSA, Nedbank, Capitec, FNB, Standard, Investec] |

No *required if beneficiary account number set |

| hash | string | A sha256 hash of account details and API salt | No *required if beneficiary account number set |

| eft_token | guid | Eft Token to be used for recurring transactions Note: This can only be sent if payment_type is eft |

No |

Credit Card payment parameters:

| Attribute | Type | Description | Required |

|---|---|---|---|

| card_token | guid | Credit Card Token to be used for recurring transactions Note: This can only be sent if payment_type is credit_card |

No |

| card_token_3ds | boolean(0 or 1) | Enable/Disable 3ds for Credit Card token payment if gateway supports it | No (will default to backend setting) |

curl -X POST -u validusername:validpassword https://eft.ppay.io/api/v1/payment-key -d "payment_type=all&amount=1&merchant_reference=testref123"

{

"key": "4ea1ea853463dab5b24f7066c1fc8f4b",

"url": "https://eft.ppay.io/eft?payment_key=4ea1ea853463dab5b24f7066c1fc8f4b",

"origin": "https://eft.ppay.io"

}

// PHP

$stringToHash = $beneficiary_account_number.$beneficiary_name.$beneficiary_account_type.$beneficiary_bank.$api_salt;

$hash = hash('sha256', strtolower($stringToHash));

// RUBY

require 'digest'

stringToHash = beneficiary_account_number+beneficiary_name+beneficiary_account_type+beneficiary_bank+api_salt;

hash = Digest::SHA256.hexdigest(stringToHash.downcase);

// PYTHON

import hashlib

string_to_hash = beneficiary_account_number+beneficiary_name+beneficiary_account_type+beneficiary_bank+api_salt

hash = hashlib.sha256(string_to_hash.lower()).hexdigest()

The EFTsecure service is our instant EFT payment method. It requires a customer to login as if on their internet banking system and automates the rest of the payment process and notifies to merchant through web hooks or enterprise api's that the payment has been made. A merchants banking details can be setup under settings→eft in the admin console.

Integration methods:

Requirements

Our hosted method for instant EFT's requires minimal development.

It requires a redirect to a endpoint which will in turn be the payment page hosted on our platform.

After a payment is complete we can notify your system through our web hooks or you can do a lookup of the transaction.

First you will need to create a payment key. This will be used to setup the payment.

https://eft.ppay.io/eft?payment_key={generatedPaymentKey}

This integration method gives you more flexibility and allows you to host it on your own website/platform.

You can apply your own stylesheet or use our bootstrap stylesheet. See framework option in the javascript library.

After a payment is complete we can notify your system through our web hooks or you can do a lookup of the transaction.

First you will need to create a Payment key. This will be used by the library to authenticate every jsonp call and save your initial data.

Then you will need to copy a code snippet (see example below) onto your page which will invoke a EFTsecure javascript plugin. Link to javascript plugin

EFTsecure javascript plugin parameters:

| Attribute | Type | Description | Required |

|---|---|---|---|

| key | string | Payment key generated server side | Yes |

| baseUrl | string Default:https://eft.ppay.io |

Overrides base url for plugin api calls (eg. for white labelled domains) | No |

| formId | string default:"eftx-form" |

The html ID of the form to populate | No |

| titleId | string default:"eftx-title" |

The html ID of the primary heading to populate | No |

| subTitleId | string default:"eftx-subtitle" |

The html ID of the secondary heading to populate | No |

| cssFramework | string[plain,bootstrap] default:"plain" |

How to format the html for the form | No |

| buttonContainerId | string | Override to specify a specific button container | No |

| onLoadStart | callback | Executed when form is submitted on each step | No |

| onLoadStop | callback | Executed when result is received for each step | No |

Add the following to your <head> tag:

<!-- If you do not already use jQuery include it -->

<script type="text/javascript" src="https://code.jquery.com/jquery-1.12.4.min.js"></script>

<script type="text/javascript" src="https://eft.ppay.io/js/eft-secure.min.js"></script>

Copy and paste the following html and insert the dynamic {{parameters}}:

<!-- Eftx plain START -->

<h1 id="eftx-title">Initialising Transaction</h1>

<div>Merchant: {{merchantName}} ({{merchantBank}}), Amount: {{currencyFormattedAmount}}</div>

<h2 id="eftx-subtitle"></h2>

<div id="loader" style="display: none;">Loading...</div>

<form id="eftx-form" autocomplete="false"></form>

<div style="clear:both"></div>

<div id="eftx-button-container"></div>

<script>

$(document).ready(function() {

new Eftx({

key: "{{paymentKey}}",

formId: "eftx-form",

titleId: "eftx-title",

subTitleId: "eftx-subtitle",

cssFramework: "plain",

buttonContainerId: "eftx-button-container",

//onCancelUrl: "{{yourCancelUrl}}",

//onCompleteUrl: "{{yourCompleteUrl}}",

onLoadStart: function(){

$("#loader").hide();

$("#eftx-form").hide();

$("#eftx-button-container").hide();

//Do other stuff here

},

onLoadStop: function(){

$("#loader").addClass("hide");

$("#eftx-form").show();

$("#eftx-button-container").show();

//Do other stuff here

}

});

});

</script>

<!-- Eftx plain END -->

Add the following to your <head> tag:

<!-- If you do not already use jQuery include it -->

<script type="text/javascript" src="https://code.jquery.com/jquery-1.12.4.min.js"></script>

<script type="text/javascript" src="https://eft.ppay.io/js/eft-secure.min.js"></script>

<link rel="stylesheet" type="text/css" href="https://eft.ppay.io/css/eftx.css">

Copy and paste the following html and insert the dynamic {{parameters}}:

<!-- Eftx boostrap START -->

<div class="eft modal" id="eftxModal" tabindex="-1" role="dialog" aria-labelledby="title">

<div class="modal-dialog" role="document">

<div class="modal-content">

<div class="modal-header">

<h4 class="modal-title pull-left" id="eftx-title">Initialising Transaction</h4>

<h4 class="modal-title pull-right">Amount: {{currencyFormattedAmount}}</h4>

<div class="clearfix"></div>

<div>Merchant: {{merchantName}} ({{merchantBank}})</div>

</div>

<div class="modal-body">

<h4 id="eftx-subtitle"></h4>

<div class="eftx-loader">

<div class="container">

<div class="loader">

<div class="loader--dot"></div>

<div class="loader--dot"></div>

<div class="loader--dot"></div>

<div class="loader--dot"></div>

<div class="loader--dot"></div>

<div class="loader--dot"></div>

<div class="loader--text"></div>

</div>

</div>

</div>

<form id="eftx-form" autocomplete="false"></form>

<div class="clearfix"></div>

</div>

<div class="modal-footer" id="eftx-button-container">

</div>

</div>

</div>

</div>

<script type="text/javascript">

$(document).ready(function() {

new Eftx({

key: "{{paymentKey}}",

//enum[bootstrap, none]

cssFramework: "bootstrap",

buttonContainerId: "eftx-button-container",

//onCancelUrl: "{{yourCancelUrl}}",

//onCompleteUrl: "{{yourCompleteUrl}}",

backgroundEnabled: true,

onLoadStart: function(){

$(".eftx-loader").removeClass("hide"); $("#eftx-form").hide();

$(".modal-footer button").hide();

//Do other stuff here

},

onLoadStop: function(){

$(".eftx-loader").addClass("hide"); $("#eftx-form").show();

$(".modal-footer button").show();

//Do other stuff here

}

});

});

</script>

<!-- Eftx bootstrap END -->

Fetche EFTsecure banks that are currently available and enabled.

Request Method: GET

Url: https://eft.ppay.io/api/v1/eft/enabled-banks

Returned attributes::

| Type | Description |

|---|---|

| list | List of all enabled banks |

curl -X GET -u validusername:validpassword https://eft.ppay.io/api/v1/eft/enabled-banks

["absa","standard","fnb","nedbank","capitec","investec","tyme","bidvest"]

A service for accepting Credit Card payments via Redirect, Checkout, Server to Server.

Integration methods:

Requirements

Our hosted method for instant Credit Cards requires minimal development.

It requires a redirect to a endpoint which will in turn be the payment page hosted on our platform.

After a payment is complete we can notify your system through our web hooks or you can do a lookup of the transaction.

First you will need to create a payment key. This will be used to setup the payment.

Server to server ZAR credit card payments

Request Method: POST

Url: https://eft.ppay.io/api/v1/pay/direct

Responses of type "result":

Transaction result received and can be details directly available in the response.

You must check the status of the transaction in api result or webhook body by checking the "status" field

Available statuses:

| Status | Description |

|---|---|

| complete | has been completed/settled succesfully |

| failed | transaction has failed |

| refunded | transaction has been refunded |

| partially-refunded | transaction has been partially refunded |

Responses of type "3ds_redirect":

3D authentication is required by the gateway. Customer will need to be redirected to the specified url and transaction can be reconciled using the redirect or webhook response..

NB: We strongly recommend implementing webhooks since redirects can fail for a variety of reasons. If using only using the redirect result we strongly recommend confirming the status and amount via the View Transaction API call

Post parameters:

| Attribute | Type | Description | Required |

|---|---|---|---|

| pan | number | Credit card number | Yes |

| expiry | string | {m}{y} ie 1220 | yes |

| cvv | number | 3 to 5 digits | yes |

| amount | decimal (ZAR) | ie. 10.00 | Yes |

| merchant_reference | string | max 20 chars | yes |

| first_name | string | max 20 chars | no |

| last_name | string | max 20 chars | no |

| return_url | string | to return from auth | if 3ds enabled |

| notify_url | string | Server to server webhook | no |

Fields for 3D Secure 2:

These fields are optional, however might be required when using certain payment gateways with 3D Secure 2.

Post parameters:

| Attribute | Type | Example |

|---|---|---|

| screen_color_depth | string | 24 |

| java_enabled | string | True |

| navigator_language | string | en-US |

| window_inner_height | string | 390 |

| window_inner_width | string | 1848 |

| timezone | string | -120 |

| navigator_user_agent | string | Mozilla/5.0 (X11; Ubuntu; Linux x86_64; rv:90.0) Gecko/20100101 Firefox/90.0 |

curl -X POST -u validusername:validpassword https://eft.ppay.io/api/v1/pay/direct -d "amount=1.00&merchant_reference=yourReference&pan=4242424242424242&expiry=1223&cvv=123&first_name=John&last_name=Doe"

{

"type": "result",

"transaction": {

"id": 1356875,

//Payment success flag

"successful": 1,

"status": "complete",

"amount": "1.00",

//Reason to be used if not successfull

"reason": "n/a",

"displayAmount": "R1.00",

"currency": "ZAR",

"merchant_reference": "yourReference",

"gateway_reference": "8ac7a4a068f0543a0169050233c8335c",

"payment_key": "0cd95fd9adabdc00275fdf6eef675950",

"created": "2019-02-19 09:07:02",

"refunded_amount": "0.00",

"refunded": 0,

"service": "Direct",

"gateway": "Peach Payments",

//Dynamic gateway response. Different per gateway

"gateway_response_parameters": {...}

}

}

curl -X POST -u validusername:validpassword https://eft.ppay.io/api/v1/pay/direct -d "amount=1.00&merchant_reference=yourReference&pan=4242424242424242&expiry=1223&cvv=123&first_name=John&last_name=Doe&return_url=http://myreturnurl.com"

{

"type": "3ds_redirect",

"redirect_url": "https://eft.ppay.io/gatewaytransactions/3ds/?transactionID=1356876",

"gateway_transaction_id": "1356876"

}

Token Payment Methods:

Tokenisation Methods:

The RealtimeEFT service is a bank account monitoring service to automatically recon any payments made to that account. It does not instantly confirm interbank payments but works on the same principals as EFTsecure. It requires a customer to login into their internet banking platform, make a payment to the required banking details and notifies to merchant through web hooks or enterprise api's that the payment has been made. A merchants monitoring banking details can be setup under Settings → Service Settings →Realtime Eft in the admin console.

Integration methods:

Requirements

This integration method allows you to host EFT, Credit Card payments on your own website/platform and still descope you from PCI compliance.

NB: A SSL certificate is required to ensure compatibility with the frame.

First you will need to create a Payment key. This will be used by the widget to authenticate the payment in the frame.

NB: When creating a payment key you must specify the redirect success and error urls, if not set page will redirect to default receipt page after transaction

You will need to copy a code snippet (see example below) onto your page which will invoke a EFTsecure checkout widget. Click here to view a live example

Checkout widget parameters:

| Attribute | Type | Description | Required |

|---|---|---|---|

| paymentKey | string | Payment key generated server side | Yes |

| paymentType | string |

Force payment type [eft,credit_card] | No |

| onLoad | event | Override for example re-enable payment button | No |

| cardOptions | object | Enable Card options Eg. "rememberCard" default value 0 | No |

Add the following to your <head> tag:

<!-- If you do not already use jQuery include it -->

<script type="text/javascript" src="https://code.jquery.com/jquery-1.12.4.min.js"></script>

<!-- The data-origin attribute value is the origin value returned from the payment key API call -->

<!-- Also ensure that the id attribute is set to og-checkout -->

<script type="text/javascript" src="https://eft.ppay.io/ext/checkout/v3/checkout.js" id="og-checkout" data-origin="https://eft.ppay.io"></script>

Copy and paste the following html and insert the dynamic {{parameters}}:

<form id="#payment-form" action="/checkout?confirm=1" style="margin-top: 50px">

<div class="text-center">

<button id="pay-button" class="btn btn-primary btn-sx" type="button" data-payment-key="{{paymentKey}}">Pay</button>

</div>

</form>

<script type="text/javascript">

$(function() {

$('#pay-button').on('click', function() {

$(this).hide();

var paymentKey = $(this).data('payment-key');

eftSec.checkout.init({

paymentKey: paymentKey,

paymentType: 'credit_card', // optional: force payment type

onLoad: function() {

$('#pay-button').show();

},

cardOptions: { //optional for Tokenizing Card

rememberCard: false,

rememberCardDefaultValue: 0

},

});

});

});

</script>

Create Recon payment

Request Method: POST

Url: https://eft.ppay.io/api/v1/pay/manual

Will add a recon payment entry to the database, payment for each recon payment will have to be confirmed manually by an Administrator in the admin area.

Post parameters:

| Attribute | Type | Description | Required |

|---|---|---|---|

| amount | decimal | ie. 10.00 | Yes |

| merchant_reference | string | custom merchant reference | No |

| bank_reference | string | custom reference that appears on customer statement | No |

| payment_date | string | Must be formatted YYYY-MM-DD HH:MM ie. 2018-03-01 12:30 | No |

curl -X POST -u validusername:validpassword https://eft.ppay.io/api/v1/pay/manual -d "amount=25.00&merchant_reference=your_reference&bank_reference=your_bank_ref&payment_date=2018-03-01 12:30"

{

"amount":"25.00",

"reference":"your_reference",

"bank_reference":"your_bank_ref",

"payment_date":"2018-03-01 12:30"

}

Process withdrawals to customer bank accounts. This is batched on intervals or manually.

Note: Cut-off time for same day payouts is 14:30 SAST.

Validate accounts/payouts before queuing.

Request Method: POST

Url: https://eft.ppay.io/api/v1/payout/validate-account

NB: Following are valid banks for transaction[bank] field:

[FNB, ABSA, Standard, Nedbank, Capitec, Investec, Capitec Business, Bidvest, Tyme, Windhoek, African Bank, Oldmutual, Discovery, Grindrod, Ubank, Imperial, Firstrand, HSBC, Sasfin, Access, Stdchartered]

NB: Following universal banking branch codes can be used for the transaction[branch] field:

[

fnb => 250655

absa => 632005

standard => 051001

nedbank => 198765

capitec => 470010

investec => 580105

capitec_business => 450105

bidvest => 462005

tyme => 678910

windhoek => 483872

afribank => 430000

oldmutual => 462005

discovery => 679000

grindrod => 584000

ubank => 431010

imperial => 39001

firstrand => 201419

hsbc => 587000

sasfin => 683000

access => 410506

stdchartered => 730020

bankbai => Null

atlantico => Null

bankbfa => Null

bancosol => Null

bancobic => Null

bankzero => 888000

]

A reference is required, this value must be unique. An account will not validate if an existing record has this reference

See curl examples for posting single or multiple transaction on the right

Post parameters:

| Attribute | Type | Description | Required |

|---|---|---|---|

| transaction | array | A single eft transaction for refund, required fields: bank, branch, account, customer_name, reference | No |

| transactions | array | Multiple eft transactions for refund, required fields bank, branch, account, customer_name, reference Transactions index must be set | No |

curl -X POST -u validusername:validpassword https://eft.ppay.io/api/v1/payout/validate-account -d "transaction[bank]=ABSA&transaction[branch]=632005&transaction[account]=4062221111&transaction[account_type]=cheque&transaction[customer_name]=jon%20doe"

{

"success": true,

"message": "Accounts validated successfully",

"transactions": [

{

"bank": "ABSA",

"branch": "632005",

"account_type": "cheque",

"customer_name": "jon doe",

"account": "4062221111"

}

]

}

curl -X POST -u validusername:validpassword https://eft.ppay.io/api/v1/payout/validate-account -d "transactions[0][bank]=ABSA&transactions[0][branch]=632005&transactions[0][account]=4062229111&transactions[0][account_type]=cheque&transactions[0][customer_name]=jon%20doe& transactions[1][bank]=Nedbank&transactions[1][branch]=198765&transactions[1][account]=113622222&transactions[1][account_type]=savings&transactions[1][customer_name]=jane%20doe"

{

"success": true,

"message": "Accounts validated successfully",

"transactions": [

{

"branch": "632005",

"account": "4062229551",

"account_type": "cheque",

"customer_name": "jon doe",

"bank": "ABSA"

},

{

"bank": "Nedbank",

"branch": "198765",

"account": "113622222",

"account_type": "savings",

"customer_name": "jane doe"

}

]

}

Verify accounts/payouts before queuing.

Request Method: POST

Url: https://eft.ppay.io/api/v1/payout/verify-account

NB: Following universal banking branch codes can be used for the branchCode field:

[

fnb => 250655

absa => 632005

standard => 051001

nedbank => 198765

capitec => 470010

investec => 580105

capitec_business => 450105

bidvest => 462005

tyme => 678910

windhoek => 483872

afribank => 430000

oldmutual => 462005

discovery => 679000

grindrod => 584000

ubank => 431010

imperial => 39001

firstrand => 201419

hsbc => 587000

sasfin => 683000

access => 410506

stdchartered => 730020

bankbai => Null

atlantico => Null

bankbfa => Null

bancosol => Null

bancobic => Null

bankzero => 888000

]

identification_type possible values are:

See curl examples for posting a single transaction on the right

Post parameters:

| Attribute | Type | Description | Required |

|---|---|---|---|

| transaction | array | A single eft transaction for verification, required fields: account_type, account_number, branch_code, identification_type, identification_number, name .optional fields: initials, email_address, cell_number | Yes |

curl -X POST -u validusername:validpassword https://eft.ppay.io/api/v1/payout/verify-account -d "transaction[account_type]=current&transaction[account_number]=1002301378&transaction[branch_code]=145710&transaction[identification_type]=SPP&transaction[identification_number]=HG7072J76211&transaction[name]=DOE&transaction[initials]=JD"

{

"success": true,

"transactions": [

{

"status": "Success",

"customerReference": "Ref1698652238",

"accountExists": "Yes",

"identificationNumberMatched": "No",

"initialsMatched": "No",

"nameMatched": "No",

"accountActive": "Yes",

"accountDormant": "No",

"accountActive3Months": "Yes",

"canDebitAccount": "Yes",

"canCreditAccount": "Yes",

"taxReferenceMatch": "Unprocessed",

"accountTypeMatch": "Yes",

"emailMatched": "Unprocessed",

"cellNumberMatched": "Unprocessed",

"completeMatch": "Unprocessed"

}

]

}

Queues a payout for batching.

Batching can be done periodically by the merchant or partner as required. Batching cut off times for same day payouts is 13:30 SAST.

Request Method: POST

Url: https://eft.ppay.io/api/v1/payout/queue

NB: Following are valid banks for transaction[bank] field:

[FNB, ABSA, Standard, Nedbank, Capitec, Investec, Capitec Business, Bidvest, Tyme, Windhoek, African Bank, Oldmutual, Discovery, Grindrod, Ubank, Imperial, Firstrand, HSBC, Sasfin, Access, Stdchartered]

NB: Following universal banking branch codes can be used for the transaction[branch] field:

[

fnb => 250655

absa => 632005

standard => 051001

nedbank => 198765

capitec => 470010

investec => 580105

capitec_business => 450105

bidvest => 462005

tyme => 678910

windhoek => 483872

afribank => 430000

oldmutual => 462005

discovery => 679000

grindrod => 584000

ubank => 431010

imperial => 39001

firstrand => 201419

hsbc => 587000

sasfin => 683000

access => 410506

stdchartered => 730020

bankbai => Null

atlantico => Null

bankbfa => Null

bancosol => Null

bancobic => Null

bankzero => 888000

]

NB: Following are valid account types for transaction[account_type] field:

[cheque, savings, transmission]

A reference is required, this alphanumeric value must be unique. An account will not be saved if an existing record has this reference

See curl examples for posting single or multiple transaction on the right

Post parameters:

| Attribute | Type | Description | Required |

|---|---|---|---|

| transaction | array | A single eft transaction for refund, required fields bank, branch, account, customer_name, amount, reference | No |

| transactions | array | Multiple eft transactions for refund, required fields bank, branch, account, customer_name, amount, reference. Transactions index must be set | No |

curl -X POST -u validusername:validpassword https://eft.ppay.io/api/v1/payout/queue -d "transaction[bank]=ABSA&transaction[amount]=100&transaction[branch]=632005&transaction[account]=4062221111&transaction[account_type]=cheque&transaction[customer_name]=jon%20doe&transaction[reference]=1234"

{

"success": true,

"message": "Accounts successfully saved",

"total_amount": 100,

"transactions": [

{

"bank": "ABSA",

"amount": "100",

"branch": "632005",

"customer_name": "jon doe",

"account_type": "cheque",

"reference": "1234",

"account": "4062221111",

"id": 19721

}

]

}

curl -X POST -u validusername:validpassword https://eft.ppay.io/api/v1/payout/queue -d "transactions[0][bank]=ABSA&transactions[0][amount]=100&transactions[0][branch]=632005&transactions[0][account]=4062229111&transactions[0][account_type]=cheque&transactions[0][customer_name]=jon%20doe&transactions[1][bank]=Nedbank&transactions[1][amount]=50.50&transactions[1][branch]=198765&transactions[1][account]=113622222&transactions[1][account_type]=savings&transactions[1][customer_name]=jane%20doe"

{

"success": true,

"message": "Accounts successfully saved",

"total_amount": 150.50,

"transactions": [

{

"branch": "632005",

"account": "4062229551",

"amount": "100",

"customer_name": "jon doe",

"account_type": "cheque",

"bank": "ABSA",

"id": 19722

},

{

"bank": "Nedbank",

"branch": "198765",

"amount": "50.50",

"account": "113622222",

"account_type": "savings",

"customer_name": "jane doe",

"id": 19723

}

]

}

Retrieves information about a payout by ID.

NB: Payouts are not realtime. They are sent in batches to the banks and are considered paid out until the bank let us know otherwise. This API call is mainly to confirm information for the payout and could also be used to know when it was batched.

Request Method: GET

Url: https://eft.ppay.io/api/v1/payout/$PAYOUT_TRANSACTION_ID

Returned attributes:

| Attribute | Type | Description |

|---|---|---|

| bank | string | Customer bank eg. Nedbank |

| branch | integer | Bank branch number |

| account | integer | Customer account number |

| amount | integer | Amount to be paid out |

| customer_name | string | Customer name |

| external_reference | string | batch reference, if not batched yet will be null |

| batch_date | date | The date batched, if not batched yet will be null |

| status | string | The status of the Payout, possible statuses pending, batched, processing and rejected. |

| payout_estimated_date | date | an estimate of the payout date, if not batched yet will be null |

curl -X GET -u validusername:validpassword https://eft.ppay.io/api/v1/payout/100

{

"bank": "Nedbank",

"branch": "198765",

"account": "1136236759",

"amount": "120.00",

"customer_name": "John Doe",

"external_reference": "3CALLFINRE000126",

"batch_date": "2017-02-16 06:35:17",

"status": "batched",

"payout_estimated_date": "2017-02-16"

}

This API call creates a payout key and link for the payout widget. This widget allows a customer to fill in a their bank account details and save it. The payout that is saved will be queued and can be batched from the admin area..

Request Method: POST

Url: https://eft.ppay.io/api/v1/payout/key

Post parameters:

| Attribute | Type | Description | Required |

|---|---|---|---|

| amount | decimal[10,2] | Amount of payout | Yes |

| customer_name | string | The customer name | Yes |

| reference | string | The unique reference for payout | Yes |

| redirect_url | string | URL to redirect to after payout successfully captured by customer | Yes |

| cancel_url | string | URL to redirect to if transaction cancelled | Yes |

curl -X POST -u validusername:validpassword https://eft.ppay.io/api/v1/payout/key -d 'amount=1&customer_name=Jon%20Doe&reference=ExampleRef1&redirect_url=https://www.google.com&cancel_url=https://www.youtube.com'

{

"key": "a05a9b4e8922c698d05916027d666b38",

"url": "https://eft.ppay.io/payouts/widget?key=a05a9b4e8922c698d05916027d666b38"

}

This webhook is only for rejection notices. This can happen after a payout has a batched status to the bank and days later we get a notification from the bank that the payout was indeed rejected.

Notes:

{

"success" : true,

"action" : 'Rejections',

"message" : 'Rejections received',

"transactions" : [

{

"id": '5154612',

"amount": 1,

"customer_name":'john doe',

"reference": 'your payout reference',

"batch_date": '2018-08-30 18:31:17',

"bank": 'Nedbank',

"account": '0123123123123',

"reason": 'ACCOUNT BLOCKED'

}

]

}

curl -X POST {webhook_url} -d "success=1&action=Rejections&message=Rejections+received&transactions%5B0%5D%5Bid%5D=5154612&transactions%5B0%5D%5Bamount%5D=50&transactions%5B0%5D%5Bcustomer_name%5D=T+Testing&transactions%5B0%5D%5Breference%5D=MYTEST1&transactions%5B0%5D%5Bbank%5D=Absa&transactions%5B0%5D%5Baccount%5D=9270445366&transactions%5B0%5D%5Breason%5D=Incorrect+Account+Code"Allows you to view/confirm or list a organisation transactions.

Fetch all transactions for an organisation by organisation id.' Organisation id is required in url

Request Method: GET

Url: https://eft.ppay.io/api/v1/organisation/$ORGANISATION_ID/gateway-transaction

Returned attributes per transaction:

| Attribute | Type | Description |

|---|---|---|

| id | integer | unique primary key for transaction |

| successful | integer | integer indicating whether transaction was successful or not (1 being true 0 being false) |

| amount | decimal | transaction amount |

| gateway_reference | text | payment gateway reference number |

| created | date | date and time of transaction |

| service | text | name of service used by agent |

| from_date | date (dd-mm-yyyy) | Where date >= |

| to_date | date (dd-mm-yyyy) | Where date <= |

curl -X GET -u validusername:validpassword https://eft.ppay.io/api/v1/organisation/$ORGANISATION_ID/gateway-transaction

[

{

"id": 166,

"successful": 1,

"amount": "123.00",

"gateway_reference": "Gateway_merchant_ref_1434026074",

"created": "2015-06-11 12:34:34",

"service": "Scan Card"

},

{

"id": 167,

"successful": 1,

"amount": "123.00",

"gateway_reference": "Gateway_merchant_ref_1434026303",

"created": "2015-06-11 12:38:23",

"service": "POS"

},

{

"id": 168,

"successful": 1,

"amount": "123.00",

"gateway_reference": "Gateway_merchant_ref_1434027451",

"created": "2015-06-11 12:57:31",

"service": "POS"

}

]

Download a csv containing transactions. Can be filtered by the parameters in the table below.

Request Method: GET

Url: https://eft.ppay.io/api/v1/export/gateway-transactions

Filtering attributes:

| Parameter | Type | Description |

|---|---|---|

| from_date | date (dd-mm-yyyy) | Where date >= |

| to_date | date (dd-mm-yyyy) | Where date <= |

curl -X GET -u validusername:validpassword https://eft.ppay.io/api/v1/export/gateway-transactions?from_date=12-06-2025&to_date=12-07-2025Fetch all transactions for user by user id.User id is required in url

Request Method: GET

Url: https://eft.ppay.io/api/v1/user/$USER_ID/gateway-transaction

Returned attributes per transaction:

| Attribute | Type | Description |

|---|---|---|

| id | integer | unique primary key for the transaction |

| successful | integer | integer indicating whether transaction was successful or not (1 being true 0 being false) |

| amount | decimal | transaction amount |

| gateway_reference | text | payment gateway reference number |

| created | date | date and time of transaction |

| service | text | name of service used by agent |

curl -X GET -u validusername:validpassword https://eft.ppay.io/api/v1/user/$USER_ID/gateway-transaction

[

{

"id": 166,

"successful": 1,

"amount": "123.00",

"gateway_reference": "Gateway_merchant_ref_1434026074",

"created": "2015-06-11 12:34:34",

"service": "Scan Card"

},

{

"id": 167,

"successful": 1,

"amount": "123.00",

"gateway_reference": "Gateway_merchant_ref_1434026303",

"created": "2015-06-11 12:38:23",

"service": "POS"

},

{

"id": 168,

"successful": 1,

"amount": "123.00",

"gateway_reference": "Gateway_merchant_ref_1434027451",

"created": "2015-06-11 12:57:31",

"service": "POS"

}

]

View transaction by id. Will be sent back as single object and status 200. Transaction id is required

Request Method: GET

Url: https://eft.ppay.io/api/v1/gateway-transaction/$GATEWAY_TRANSACTION_ID

Returned attributes:

| Attribute | Type | Description |

|---|---|---|

| id | integer | unique primary key for transaction |

| successful | integer | integer indicating whether transaction was successful or not (1 being true 0 being false) |

| amount | decimal | transaction amount |

| gateway_reference | text | payment gateway reference number |

| created | date | date and time of transaction |

| service | text | name of service used by agent |

curl -X GET -u validusername:validpassword https://eft.ppay.io/api/v1/gateway-transaction/$GATEWAY_TRANSACTION_IDcurl -X GET -u validusername:validpassword https://eft.ppay.io/api/v1/gateway-transaction/?reference=$MERCHANT_REFERENCE curl -X GET -u validusername:validpassword https://eft.ppay.io/api/v1/gateway-transaction/?key=$PAYMENT_KEY

{

"id": 11111,

"successful": 1,

"status": "complete",

"amount": "5.00",

"reason": "n/a",

"displayAmount": "R5.00",

"currency": "ZAR",

"merchant_reference": "1111111-11111-1111",

"gateway_reference": "11111111-0000-0000-0000-000000000000",

"payment_key": "19440ff6006e2179ea4bbd6b470693ee",

"created": "2021-02-18 11:59:58",

"refunded_amount": "0.00",

"refunded": 0,

"service": "Direct",

"gateway_response_parameters": {

"accountFrom": "30",

"accountTo": "00",

"amount": 500,

"authCode": "843199",

"card": "424242*****4242",

"cardName": "Diners",

"cardToken": "1111111-1111-1111-1111-1111111",

"currency": "710",

"dmsIndicator": false,

"echo": "52857350-dd49-46df",

"pos": "00173138",

"reference": "22117406-0000-0000-0000-000000000000",

"responseCode": "00",

"responseText": "Approved",

"rrn": "00001111111",

"seq": "1111111",

"store": "000000001111111",

"storeDetails": {

"city": "Cape Town ",

"country": "ZA",

"name": "Store name",

"region": "WC"

},

"tran": "00",

"tranQualifier": "008601",

"gatewayCardToken": "1111111-1111-1111-1111-1111111",

"card_token": "1111111-1111-1111-1111-1111111", // Token to be re-used

"bin": "424242"

},

"call": "",

"location": "",

"signature": null,

"is_demo_transaction": 1,

"token": "1111111-1111-1111-1111-1111111", // Token to be re-used

}

Some gateways supports refund capability of the full amount.

Request Method: PUT

Url: https://eft.ppay.io/api/v1/gateway-transaction/refund/{$transaction_id}

By default this will refund the complete transaction amount.

| Attribute | Type | Description |

|---|---|---|

| amount | float | Optional. Amount lower or equal to the transaction amount. |

curl -X PUT -u validusername:validpassword https://eft.ppay.io/api/v1/gateway-transaction/refund/12345678

{

"result": true

}

This API call allows you to resend a webhook for a transaction.

Request Method: POST

Url: https://eft.ppay.io/api/v1/gateway-transaction/resend-webhook/{$gateway_transaction_id}

This will allow you to resend your webhook and the API call requires a custom URl to attribute

| Attribute | Type | Description | Required |

|---|---|---|---|

| url | string | URL to post webhook data to | Yes |

curl -X POST -u validusername:validpassword https://eft.ppay.io/api/v1/gateway-transaction/resend-webhook/{$gateway_transaction_id} -d 'url=https://yoursite.com/webhook-endpoint'

{

"success": true,

"message": "Webhook has been queued successfully"

}

Allows you manage organisation users.

Fetch all users for an organisation by organisation id.' Organisation id is required in url

Request Method: GET

Url: https://eft.ppay.io/api/v1/organisation/$ORGANISATION_ID/user

Returned attributes per user:

| Attribute | Type | Description |

|---|---|---|

| id | integer | unique primary key for user |

| name | text | user first name |

| lastname | text | user last name |

| username | text | user username |

| valid email address | user email address | |

| contact_number | integer | user contact number |

| organisation_id | integer | user organisation id |

| created | date | date user was created |

| extension | integer | If user is type agent will return an extension for him/her |

curl -X GET -u validusername:validpassword https://eft.ppay.io/api/v1/organisation/$ORGANISATION_ID/user

[

{

"id": 2,

"name": "John",

"lastname": "Doe",

"username": "johndoe",

"email": "johndoe@merchantcompany.co.za",

"contact_number": 0821234567,

"organisation_id": 3,

"created": "2015-02-03 14:19:39",

"extension": "4444"

},

{

"id": 3,

"name": "Joe",

"lastname": "Doe",

"username": "joedoe",

"email": "joedoe@merchantcompany.co.za",

"contact_number": 0821234567,

"organisation_id": 3,

"created": "2015-02-03 14:19:39",

"extension": "5555"

}

]

View existing user by User id. Will be sent back as single object and status 200. User id is required

Request Method: GET

Url: https://eft.ppay.io/api/v1/user/$USER_ID

Returned attributes:

| Attribute | Type | Description |

|---|---|---|

| id | integer | unique primary key for user |

| name | text | user first name |

| lastname | text | user last name |

| username | text | user username |

| valid email address | user email address | |

| contact_number | integer | user contact number |

| organisation_id | integer | user organisation id |

| created | date | date user was created |

| extension | integer | If user is type agent will return an extension for him/her |

curl -X GET -u validusername:validpassword https://eft.ppay.io/api/v1/user/3

{

"id": 3,

"name": "Joe",

"lastname": "Doe",

"username": "joedoe",

"email": "joedoe@merchantcompany.co.za",

"contact_number": 0821234567,

"organisation_id": 3,

"created": "2015-02-03 14:19:39",

"extension": "5555"

}

Create new user Will be send back a single object (see View User for returned attributes) and status 201 (Created).

Request Method: POST

Url: https://eft.ppay.io/api/v1/user

User Post parameters: post as User[$ATTRIBUTE]

| Attribute | Type | Description | Required |

|---|---|---|---|

| username | text | user username | Yes |

| role | valid user role | See list of user roles | Yes |

| password | text | user password | No |

| name | text | user first name | No |

| lastname | text | user last name | No |

| valid email address | user email address | No | |

| contact_number | integer | user contact number | No |

curl -X POST -u validusername:validpassword https://eft.ppay.io/api/v1/user -d "User[username]=unique&User[role]=agent"

{

"id": 8,

"name": null,

"lastname": null,

"username": "unique",

"email": null,

"contact_number": null,

"organisation_id": 3,

"created": "2015-02-03 14:19:39",

"extension": null

}

Update existing organisation by User id.User id is required in url'); ?>

Request Methods: PUT

Url: https://eft.ppay.io/api/v1/user/$USER_ID

User Put parameters: post as User[$ATTRIBUTE]

| Attribute | Type | Description |

|---|---|---|

| username | text | user username |

| password | text | user password |

| role | valid user role | See list of user roles |

| name | text | user first name |

| lastname | text | user last name |

| valid email address | user email address | |

| contact_number | integer | user contact number |

curl -X PUT -u validusername:validpassword https://eft.ppay.io/api/v1/user/8 -d "User[name]=Jason"

{

"id": 8,

"name": "Jason",

"lastname": null,

"username": "unique",

"email": null,

"contact_number": null,

"organisation_id": 3,

"created": "2015-02-03 14:19:39",

"extension": null

}

Allows you manage your merchant organisations.

Fetch all merchant organisations belonging to your company. Will be sent back as an array of objects

Request Method: GET

Url: https://eft.ppay.io/api/v1/organisation

Returned attributes per organisation:

| Attribute | Type | Description |

|---|---|---|

| id | integer | unique primary key for organisation |

| name | text | name of organisation |

| company_registration | text | company registration number of organisation |

| vat_number | integer | company vat number of organisation |

| website | text | company vat number of organisation |

| contact_email | text | contact email for organisation |

| billing_email | text | billing email for organisation |

| contact_number | integer | contact number for organisation |

curl -X GET -u validusername:validpassword https://eft.ppay.io/api/v1/organisation

[

{

"id": 1,

"name": "merchant company",

"company_registration": null,

"website": null,

"vat_number": null,

"contact_email": "joe@merchantcompany.com",

"contact_number": null,

"billing_email": "billing@merchantcompany.com"

},

{

"id": 2,

"name": "merchant company 2",

"company_registration": null,

"website": null,

"vat_number": null,

"contact_email": "joe@merchantcompany2.com",

"contact_number": null,

"billing_email": "billing@merchantcompany2.com"

}

]

Fetch all services belonging to your company. Will be sent back as an array of service slugs

Request Method: GET

Url: https://eft.ppay.io/api/v1/organisation/$ORGANISATION_ID/services

curl -X GET -u validusername:validpassword https://eft.ppay.io/api/v1/organisation/$ORGANISATION_ID/services

["eft","credit_card"]

View existing organisation by Organisation id. Will be sent back as single object and status 200. Organisation id is required

Request Method: GET

Url: https://eft.ppay.io/api/v1/organisation/$ORGANISATION_ID

Returned attributes:

| Attribute | Type | Description |

|---|---|---|

| id | integer | unique primary key for organisation |

| name | text | name of organisation |

| company_registration | text | company registration number of organisation |

| vat_number | integer | company vat number of organisation |

| website | text | company vat number of organisation |

| contact_email | text | contact email for organisation |

| billing_email | text | billing email for organisation |

| contact_number | integer | contact number for organisation |

curl -X GET -u validusername:validpassword https://eft.ppay.io/api/v1/organisation/2

{

"id": 2,

"name": "merchant company 2",

"company_registration": null,

"website": null,

"vat_number": null,

"contact_email": "joe@merchantcompany2.com",

"contact_number": null,

"billing_email": "billing@merchantcompany2.com"

}

Create new organisation by Organisation id. Will be send back a single object (see View Organisation for returned attributes) and status 201 (Created).

WHEN CREATING A NEW ORGANISATION A DEFAULT ADMIN USER MUST BE CREATED AS WELL. NEW USER PARAMETERS MUST BE POSTED WITH PAYLOAD, SEE CREATE USER

Request Method: POST

Url: https://eft.ppay.io/api/v1/organisation

Services for organisation:

post as array eg.

Organisation[serviceList][] = $SERVICEID1;

Organisation[serviceList][] = $SERVICEID2;

etc.

See list of available services

A physical and billing address is also required

example post:

billingAddress[address_line_1] = '45 Fifth Avenue';

billingAddress[address_line_2] = 'Suburb';

billingAddress[address_line_3] = 'City';

billingAddress[postal_code] = 1234;

Post physical address in same way, eg. physicalAddress[address_line_1]

Organisation Post parameters: post as Organisation[$ATTRIBUTE]

| Attribute | Type | Description | Required |

|---|---|---|---|

| name | text | name of organisation | Yes |

| serviceList | array of service ids | List of services for organisation posted as array, at least one must be posted on creation of organisation, see available services | Yes |

| billingAddress | text | See how to post above table | Yes |

| physicalAddress | text | See how to post above table | Yes |

| contract_type_id | integer | See contract types | Yes |

| contract_start_date | valid date | Must be a valid date in the following format MM-YYYY (eg June 2015 will be 06-2015). NB* must be after current month (eg if it is February 2015 minimum contract date must be March 2015) |

Yes |

| company_registration | text | company registration number of organisation | No |

| vat_number | integer | company vat number of organisation | No |

| website | Valid website url | company vat number of organisation | No |

| contact_email | Valid email address | contact email for organisation | No |

| billing_email | Valid email address | billing email for organisation | No |

| contact_number | integer | contact number for organisation | No |

| contact_number | integer | contact number for organisation | No |

curl -X POST -u validusername:validpassword https://eft.ppay.io/api/v1/organisation -d "Organisation[name]=organisation%20name&User[username]=unique&User[password]=password&Organisation[serviceList][]=1&billingAddress[address_line_1]=address%20line%201&billingAddress[address_line_2]=address%20line%202&billingAddress[postal_code]=1234&physicalAddress[address_line_1]=address%20line%201&physicalAddress[address_line_2]=address%20line%202&physicalAddress[postal_code]=1234" -u validusername:validpassword

{

"id": 14,

"name": "organisation name",

"company_registration": null,

"website": null,

"vat_number": null,

"contact_email": null,

"contact_number": null,

"billing_email": null,

"serviceList": [

"1"

]

}

Add organisation banking details. Organisation id is required in url

Request Method: POST

Url: https://eft.ppay.io/api/v1/organisation/$ORGANISATION_ID/eft-banking-details

Will add banking details for EFT secure.

Limited to one account per bank.

Post parameters:

| Attribute | Type | Description | Required |

|---|---|---|---|

| account_number | decimal | ie. 4061112222 | Yes |

| account_type | string | bank account type [cheque, savings, transmission] |

Yes |

| account_name | string | Account name eg. My account | Yes |

| branch_code | decimal | The bank account branch code | Yes |

| bank | string | The name of the bank [ABSA, Nedbank, Capitec, FNB, Standard, Investec] |

Yes |

curl -X POST -u validusername:validpassword https://eft.ppay.io/api/v1/organisation/10/eft-banking-details -d "account_name=My%20Account&account_number=4062221111&bank=absa&branch_code=632005&account_type=cheque"

{

"account_name":"My Account",

"account_number":"4062221111",

"branch_code":"632005",

"bank":"absa",

"bank_account_type":"cheque"

}

Update existing organisation by Organisation id.Organisation id is required in url'); ?>

Request Methods: PUT

Url: https://eft.ppay.io/api/v1/organisation/$ORGANISATION_ID

Organisation Put parameters: post as Organisation[$ATTRIBUTE]

| Attribute | Type | Description | Required |

|---|---|---|---|

| name | text | name of organisation | No |

| serviceList | array of service ids | List of services for organisation posted as array | No |

| company_registration | text | company registration number of organisation | No |

| vat_number | integer | company vat number of organisation | No |

| website | Valid website url | company vat number of organisation | No |

| contact_email | Valid email address | contact email for organisation | No |

| billing_email | Valid email address | billing email for organisation | No |

| contact_number | integer | contact number for organisation | No |

| contact_number | integer | contact number for organisation | No |

curl -X PUT -u validusername:validpassword https://eft.ppay.io/api/v1/organisation/5 -d "Organisation[name]=new%20organisation%20name"

{

"id": 5,

"name": "New organisation name",

"company_registration": null,

"website": null,

"vat_number": null,

"contact_email": "joe@merchantcompany2.com",

"contact_number": null,

"billing_email": "billing@merchantcompany2.com"

}

Allows you update organisation settings.

Update existing organisation settings by Organisation id. Organisation id is required in url

Request Methods: PUT

Url: https://eft.ppay.io/api/v1/organisation/{$ORGANISATION_ID}/settings

Gateway credentials can be updated in the settings, for example you might want to set your gateway api key and secret for example

OrganisationSetting[gatewayCredentials]['{gateway_parameter}'] eg. OrganisationSetting[gatewayCredentials]['safeKey'] = 'xxx-xxx-xx; '

Settings PUT parameters: post as OrganisationSetting[$ATTRIBUTE]

| Attribute | Type | Description | Required |

|---|---|---|---|

| payment_success_uri | valid url | Successful transaction redirect URI | No |

| payment_error_uri | valid url | Unsuccessful transaction redirect URI | No |

| gatewayCredentials | array of gateway credentials | See above | No |

| demo_mode | integer | 2 options for demo mode: 0 or 1 (Off or On) | No |

| gateway_id | integer | See list of available gateways | No |

curl -X PUT -u validusername:validpassword https://eft.ppay.io/api/v1/organisation/3/settings -d "OrganisationSetting[demo_mode]=1"

{

"organisation_id": 3,

"payment_success_uri": null,

"payment_error_uri": null,

"gateway_id": 2,

"demo_mode": "1",

"inbound_did": "*********"

}

Allows you to update organisation licenses and activate/deactivate agent licenses.

Update amount of licenses organisation has for a service by Organisation id.Organisation id is required in url

Request Method: PUT

Url: https://eft.ppay.io /api/v1/organisation/$ORGANISATION_ID/licenseupdate

Put parameters: post array of service ids with service id as key and amount of licenses as value

eg. serviceId[$SERVICE_ID_ONE]=$AMOUNT_OF_LICENSES

eg. serviceId[$SERVICE_ID_TWO]=$AMOUNT_OF_LICENSES

See available service IDs

curl -X PUT -u validusername:validpassword https://eft.ppay.io/api/v1/organisation/10/licenseupdate -d "serviceId[1]=25&serviceId[2]=35"

{

"Organisation": "Organisation name",

"Services": {

"serviceId": {

"1": "25",

"2": "35"

}

}

}

Activate user license for service/s by user id.User id is required in url

Request Method: PUT

Url: https://eft.ppay.io/api/v1/user/$USER_ID/activate

Put parameters: post array of service ids

eg. serviceId[]=$SERVICE_ID_ONE

serviceId[]=$SERVICE_ID_TWO

See available service IDs

curl -X PUT -u validusername:validpassword https://eft.ppay.io/api/v1/user/2/activate -d "serviceId[]=1&serviceId[]=2"

{

"services": {

"service_one": "Activated",

"service_two": "Activated"

},

"User": {

"id": 2,

"name": "4315",

"lastname": "4315",

"email": "4315@yourdomain.co.za",

"username": "4315"

}

}

Deactivate user license for service/s by user id.User id is required in url

Request Method: PUT

Url: https://eft.ppay.io/api/v1/user/$USER_ID/deactivate

Put parameters: post array of service ids

eg. serviceId[]=$SERVICE_ID_ONE

eg. serviceId[]=$SERVICE_ID_TWO

See available service IDs

curl -X PUT -u validusername:validpassword https://eft.ppay.io/api/v1/user/3/deactivate -d "serviceId[]=1&serviceId[]=2"

{

"services": {

"service_one": "Deactivated",

"service_two": "Deactivated"

},

"User": {

"id": 3,

"name": "4315",

"lastname": "4315",

"email": "4315@yourdomain.co.za",

"username": "4315"

}

}

Send a payment receipt via email or sms

Use this api call to notify a customer of a successful transaction.

Templates can be set in settings.

Request Method: POST

Url: https://eft.ppay.io/api/v1/notification/send

POST parameters:

| Attribute | Type | Description |

|---|---|---|

| recipient | text | a valid mobile number or email address |

| type | text | [Sms, Email] |

| transactionID | bigint | a valid transction ID |

curl -X GET -u validusername:validpassword https://eft.ppay.io/api/v1/organisation/1/gateway-transaction -d "recipient=0720000000&type=Sms&transactionID=1"

{

"result": true

}

Fetch account data for the inbound service.

Get account data using field key and value where the key is field name and value is the field value. eg. clid would be the key and 0821234567 would be the value.

Request Method: GET

Url: https://eft.ppay.io/api/v1/organisation/ $ORGANISATION_ID/account/$KEY/$VALUE

Get parameters:

| Attribute | Type | Description | Required |

|---|---|---|---|

| key | String | this value is limited to either clid or external_reference | Yes |

| value | String | The value of this field depends on the key, if the key is clid then the value will be a contact number eg. 0821234567. If the key is external_reference it will be whatever the reference value is (id number, policy number, etc) | Yes |

curl -X GET -u validusername:validpassword https://eft.ppay.io/api/v1/organisation/1/account/clid/0836112027

{

"id": 1,

"name": "John",

"surname": "Doe",

"clid": "0831234567",

"balance": "0.00",

"external_reference": null

}

Fetch all accounts for an organisation by organisation id. Organisation id is required in url

Request Method: GET

Url: https://eft.ppay.io/api/v1/organisation/$ORGANISATION_ID/account

Returned attributes per account:

| Attribute | Type | Description |

|---|---|---|

| name | text | Account user first name |

| surname | text | Account user last name |

| clid | integer | Contact number for account |

| balance | decimal | Remaining balance for account eg. 125.00 |

| external_reference | string | This is the unique reference or account number for the account |

curl -X GET -u validusername:validpassword https://eft.ppay.io/api/v1/organisation/$ORGANISATION_ID/account

[

{

"name": "John",

"surname": "Doe",

"clid": "0831234567",

"balance": "0.00",

"external_reference": 125455582

},

{

"name": "Jane",

"surname": "Doe",

"clid": "0731234567",